Let us help you out from underneath the financial and emotional weight of debt. Give us a call today to see if we can consolidate your debt into one monthly, manageable payment.

Consolidate Debt Into A Mortgage

Remortgaging your property can be an attractive way to consolidate debt. High street banks and specialist lenders alike see the need for people to consolidate their debts from time to time and as long as there is enough equity in the property and the client still fits affordability then many are often happy to provide the mortgage. Consolidation of debt through a mortgage can help to:

Remortgaging your property can be an attractive way to consolidate debt. High street banks and specialist lenders alike see the need for people to consolidate their debts from time to time and as long as there is enough equity in the property and the client still fits affordability then many are often happy to provide the mortgage. Consolidation of debt through a mortgage can help to:- Reduce your monthly outgoings

- Restructure your finances

- Create one monthly payment

If they transferred the debt onto a credit card with an interest rate of 20% they would pay £4,000 a year in interest. Which in total, would be £6,500 a year in interest.

However, if they could remortgage the £20,000 debt at 4.5%, they would only pay £5,400 a year in interest, and would have saved £1,100 a year overall. The Overall Cost For Comparison Is 4.9 %APR

Please remember that this is only an example and securing debts against your home is an important decision. If you fail to make your repayments your home could be repossessed. If you would like us to look and see if we can consolidate your debts and save you money then please fill in our online application form and one of our advisors will give you a call.

Debt Consolidation Loans

If you are not looking to secure a new mortgage contract, even if it is to consolidate debt then there are other options available to you. There could be many reasons for not wanting a debt consolidation remortgage, maybe you already have a great rate? Or are currently in a fixed period and do not want to pay any ERCs? Well, you are not alone and a loan to consolidate the debts could be just what you are after. If you were to consolidate your debt using a loan it would mean that you would still have two payments to make each month, your mortgage and your secured loan but it would still carry many of the benefits that exist when someone decides to consolidate debt.

If you are not looking to secure a new mortgage contract, even if it is to consolidate debt then there are other options available to you. There could be many reasons for not wanting a debt consolidation remortgage, maybe you already have a great rate? Or are currently in a fixed period and do not want to pay any ERCs? Well, you are not alone and a loan to consolidate the debts could be just what you are after. If you were to consolidate your debt using a loan it would mean that you would still have two payments to make each month, your mortgage and your secured loan but it would still carry many of the benefits that exist when someone decides to consolidate debt. If you have the equity available in your property then why not consider an any purpose loan which could raise enough money to clear your existing debts and raise extra finance at the same time for those home improvements you have been meaning to get round too. It is often prudent to raise some extra money on a great rate whilst you are clearing off your debts to do the things around the house that need it. This can help to prevent you from trying to rectify them in future and building up more debts on credit cards again. If you are interested in an any purpose loan to help clear your debts then give our advisors a call on the above number and they can help you decide how much you might be looking to raise.

Consolidating Debt With Existing Bad Credit

`Bad credit` or `poor credit` can constitute a number of things and can happen to anyone so shouldn`t be something to be ashamed of. Here are the main factors that could cause bad credit (this list is not exhaustive):- Missed Payments

- Defaults

- CCJs (County Court Judgements)

- Bankruptcy

- IVAs

Consolidate Credit Card Debt

Over time it is often fairly easy to build up numerous debts that you may want to consolidate. Whether it is for personal loans, car loans or even money that you owe to a friend being able to consolidate debt into one payment and effectively declare yourself debt free can be a great financial decision, and not only that it can feel pretty good too. The biggest offender for this however, is credit cards. Many people use credit cards as long term finance which isn`t their intended purpose. When this is the case it becomes difficult to clear the credit card and instead you are left paying of the minimum payment each month, with the high interest rates that many cards hold this means that the debt will just keep building. As the interest rates on credit cards are often high in many cases you can consolidate all of your debts and end up paying less overall. Consolidating your debts, especially on credit cards can save you both time and money. Give us a call on 0800 298 3000 (landline) or 0333 0031505(mobile) and find out if by consolidating debt we can save you money each month that could go towards other much needed household finances... or just reduce your stress levels a little.

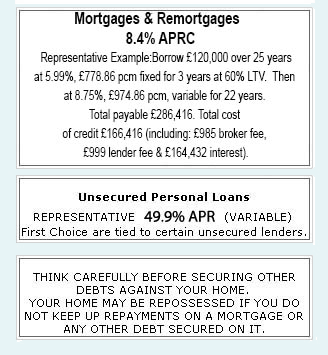

|

|

Unsecured Personal Loans |

THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST

YOUR HOME. |

Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential